Votre Guide aux Business du Cameroun

Bienvenue sur la plateforme incontournable pour découvrir les pépites du Cameroun. Trouvez des produits uniques, des services essentiels et des business de confiance en quelques clics. C'est une communauté faite pour vous — et c'est 100 % gratuit.

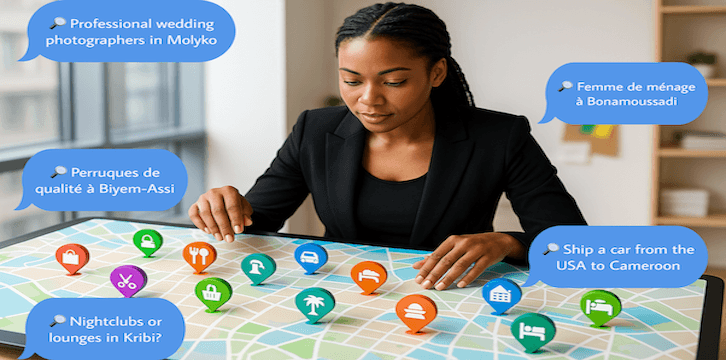

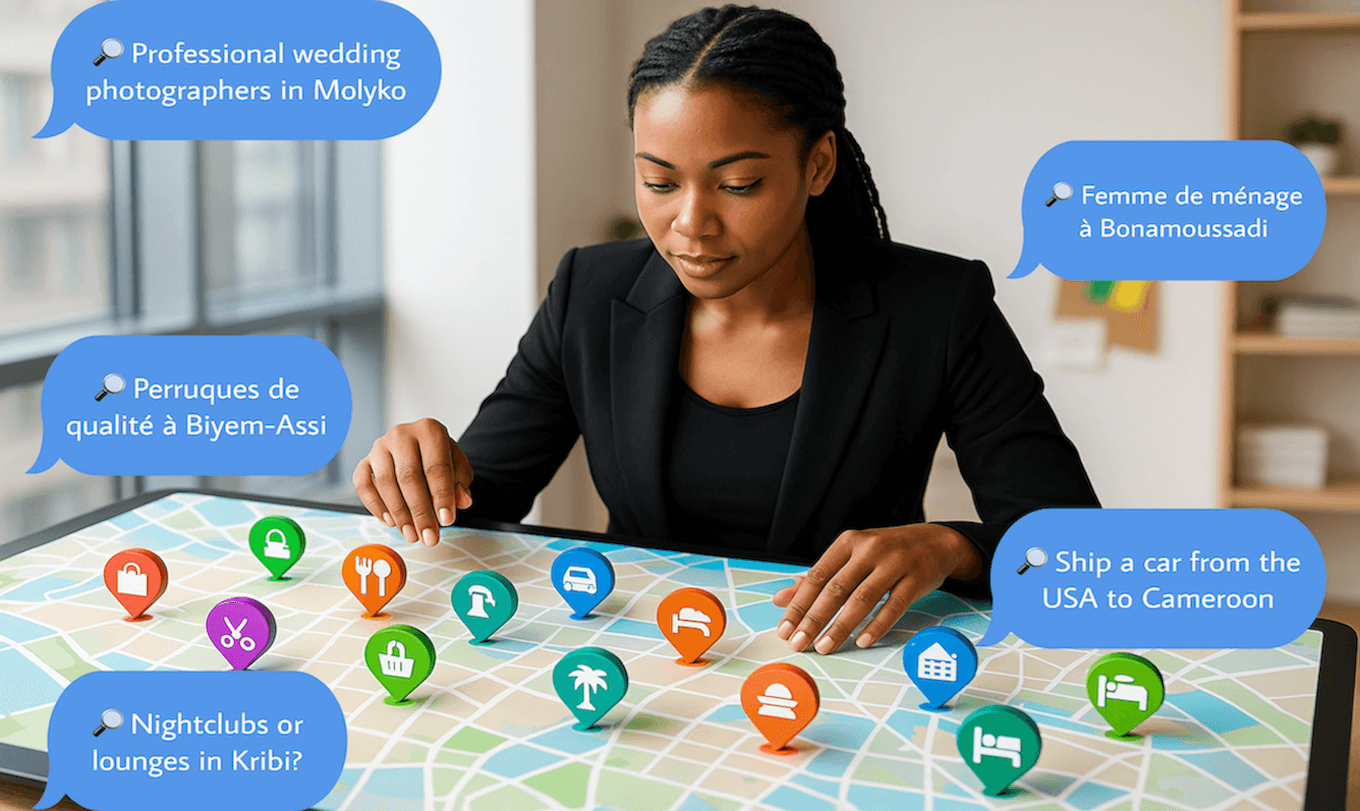

Vos découvertes à portée de main

Des boutiques de mode aux restaurants, explorez facilement un nombre croissant de business. Notre moteur de recherche intelligent et nos catégories intuitives mettent les ressources parfaites à votre disposition — et c'est 100 % gratuit.

Visibilité Digitale au Cameroun

Votre vitrine sur la population numérique croissante du Cameroun. Ajoutez votre business pour gagner en visibilité sur Google, être mis en avant sur nos réseaux sociaux et être exposé à plus de clients que jamais — et c'est 100 % gratuit.

Sélection du Mois

Le Cameroun à Portée de Main: Trouvez Tout, Listez Votre business.

Liste des business

Parcourez les catégories

Découvrez des catégories de business correspondant à vos centres d’intérêt.

Nous valorisons vos idées !

Langue

Français

Droits d’auteur © 2025. InvestingIn